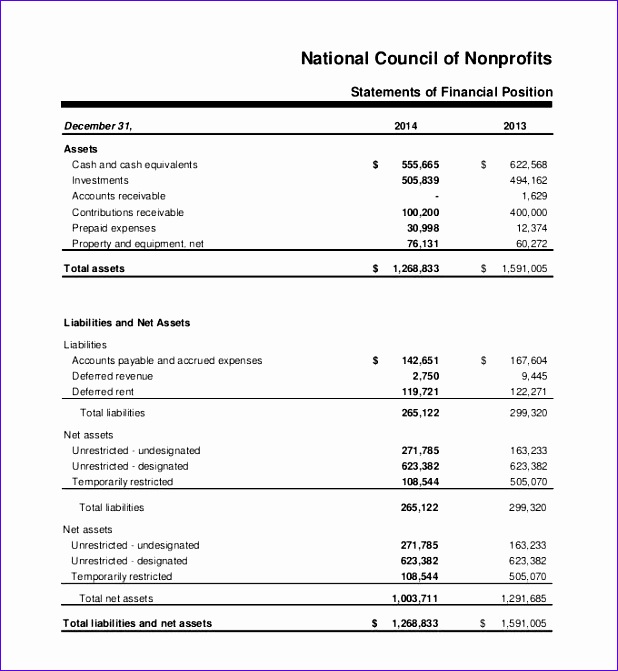

Financial statements also give donors a better understanding of how the organization is doing. You’ll also need to have a balance sheet and a snapshot of your organization’s finances at the beginning and end of the year when filing IRS tax form 990. Fixed assets are your nonprofit’s furniture, equipment, and improvements made to a facility. Fixed assets can also include accumulated depreciation, the amount your fixed assets have decreased in value. Restricted funds are donations earmarked by the donor for specific programs or purposes. These funds cannot be used for general operating expenses or other programs unless the donor explicitly allows it.

What is the Statement of Activities?

When a nonprofit shares more about its financial health, foundations and sponsors see that the nonprofit is financially viable and feel safer giving. In this article, we’ll explain more about each financial statement, why and when nonprofits need financial statements, and share examples of how organizations have used them in their annual reports. Sharing how your nonprofit’s financial status has changed gives board members, donors, and foundations a better overview of the health of your nonprofit. Financial reporting provides transparency, helps fulfill legal obligations, builds donor trust, and evaluates financial health. Your size, your activities, and your funding sources will all determine which reports you need to run your business effectively. The Notes to the Financial Statements provide additional information and explanations to the financial statements.

- Failure to file Form 990 for three consecutive years results in automatic loss of tax-exempt status.

- These associations can provide information on best practices, accounting standards, and regulatory compliance for nonprofits.

- Here’s an example of Wellington Zoo’s annual report (page 45) that includes its statement of financial position or balance sheet.

- Form 990 provides a comprehensive overview of the organization’s financial activities and is essential for maintaining tax-exempt status.

- The letter from the independent auditor highlights their opinion that Save the Children is following all required financial laws.

Statement of Cash Flows

Reading and understanding other financial documents, briefly covered below, is necessary to fill the gap. When it’s all put together, a nonprofit statement of financial position is a pretty straightforward document. Putting it together, however, can take time because there are a number of essential components you or your accounting expert will need to assemble. A nonprofit statement of financial position is one of several documents nonprofits can use to demonstrate where donors’ money is being spent.

What Is the Most Difficult Part of Preparing the Statement?

The Statement of Financial Position, also known as the balance sheet, provides a snapshot of an organization’s financial health at a specific point in time. Assets represent what the organization owns, such as cash, investments, and property. Liabilities represent what the organization owes, such as loans and accounts payable. Net assets, also known as equity or fund balance, represent the organization’s total assets minus its liabilities. The Nonprofit Balance Sheet or Statement of Financial Position reflects the financial stability of the organization. It allows stakeholders, including donors, grantors, board members, and management, to assess the organization’s financial health and sustainability.

The change in net assets without donor restrictions indicates if an organization operated the most recent fiscal period at a financial gain or loss. This line is a direct connection with and should be equal to the bottom line of an organization’s income statement (also called a Statement of Activities or profit/loss statement). The balance sheet reports an organization’s assets (what is owned) and liabilities (what is owed).

Components of a Nonprofit Balance Sheet

Having a proactive system for tracking the movement of funds during the year is the most difficult piece of reporting. Nobody wants to dig through the proverbial “shoebox” of receipts come reporting time. The budget vs. actual report helps you to easily compare what happened in your business to what you expected to happen. This report can help you explain to your board why you have less cash even after a great fundraising month (maybe you invested in some much-needed equipment). But many times they don’t fully understand what the report is, and what they’re looking for is something that’s not actually in the report. If a grant-maker or a donor gives you money that is dedicated for specific programs, or that you need to use by a specific date, it’s still an asset.

Nonprofit accounting associations offer resources, training, and support specifically tailored to the needs of nonprofit organizations. These associations can provide information on best practices, accounting standards, and regulatory compliance for aca frequently asked questions va, affordable care act and you nonprofits. A statement of cash flows is a financial statement that provides information about a nonprofit organization’s cash receipts and payments. It helps to illustrate how cash flows in an organization and cash balance changes over time.

Once you’ve got a bookkeeping system and a bank account in place, you need some way of making sure the information in both of those systems lines up. The solution you decide on should also allow you to do some form of fund accounting. This means instead of piling your money into one big “cash” account, you’ll need to distinguish between and track separate buckets of money.

Cash basis is the more convenient method when your organization is new and small, but you should consider fund accrual accounting for the long term. A nonprofit’s net assets are its assets minus its liabilities, or, in other words, any assets left over after liabilities are taken out. So it’s very important that you learn to read the IRS 990 and understand what it says about the financial health and governance of your organization. The definition of a financial statement is a simple report that can be pulled together monthly (or as-needed) to give you a view of your financial health.